Off Topic : How We Take Free International Vacations

So, this post obviously has nothing to do with boudoir photography, but I’ve talked with lots of people over the years, and I frequently (and happily!) answer the same questions over and over for how Jonathan and I take so many free vacations. Now that we’ve started traveling again post-pandemic, we were able to use our saved-up points for free business class tickets to Europe and a free trip to Greece earlier in the year.

I have a tried and true list of platforms and credit cards I love that help us maximize our money. If you enjoy the game of getting a great deal without sacrificing quality, here’s a few ideas.*

Scott’s Cheap Flights.

Especially if you’re interested in international travel, this is exactly what it sounds like. A guy named Scott scours the internet and emails you when he finds a cheap or mistake fare. If you’re a teacher or someone with a very set schedule, this may not be as beneficial. But Jonathan and I are impulsive vacationers, so it works great for us. When we went to Austria and Prague in September 2019, I called Jonathan downstairs told him there’s a flight from Nashville > London > Vienna for $500 each if we went in early November. Jonathan said to book it, so I did.

In early 2019, I found tickets to Rome for under $300. Jonathan couldn’t go, so I called my mom and we booked the flight a couple of hours later to spend 9 days in Italy.

My best SCF tip is to have a list of places you’d like to go. So for us, Jonathan and I know we’d really like to visit Italy, Barcelona, Norway, Prague, and Thailand. We’d also like to go back to Iceland when there isn’t an early season snowstorm. And we let Scott determine where we go next. When the right deal comes in, we go for it. If this sounds up your alley, I’d love if you used my referral link here.

Don’t be afraid of credit cards.

Please understand that everything in this section is applicable and worthwhile only only only if you knoooow you will pay your card off every month. The insane interest on credit cards negates any benefits you may receive from them. We use YNAB (more on this later) to help us make sure we can pay off our cards every month, so we can set them to autopay and never pay interest. I feel like we’re taught at a young age that credit cards are bad financial decisions, but I can argue that, if you pay them off monthly, it’s much more financially lucrative to have them. Even if you get these cards and take the points as cash back (please don’t), you’d make money on them.

I’ll start with my personal favorite, the Chase Sapphire Reserve. This credit card has been the single biggest game changer for us. Most of our disposable income is spent on dining out and travel, and that’s what you earn the most rewards on with this card. On top of receiving 3% of all travel and dining out, you also redeem your travel points for 50% more.

When you look into the Chase Reserve annual fee, you’ll get sticker shock because — don’t stop reading here — it’s $550/year. I know, it’s a lot, but stick with me. In that $550, you get $300 back when you spend it on groceries, fuel, or travel, so we easily get $300 back in the first month, making it cost $250/year. It also includes airport lounge access (valued at $400) and pays for your TSAPreCheck/Global Entry, which is nearly $100. So, all told, it pays for itself before you even take the rewards side of it into account. Even without the lounge access and the TSA Pre, it still more than pays for itself for us.

With the premium cards like the Chase Sapphire Reserve, you’ll want to look for how many points you can earn with the subscription bonus. The standard for this card is 60K Ultimate Rewards ($900 in travel) points. If you have a large purchase coming up that you want to earn points on, go ahead and get the card at this rate. But if you have some time to wait, it’s great to grab it when there’s an 80K ($1200 in travel) or the very rare 100K ($1500!!) bonus.

If that feels overwhelming, start with the Chase Sapphire Preferred. It is $95/year. It doesn’t have the premium benefits of the Sapphire Reserve, but it does earn points fairly quickly and is a good way to stick your toe in the water of travel cards. But NOTE: You can only have one Sapphire card at a time and you can’t earn a bonus within four years of a previous Sapphire bonus. So you can’t get the Preferred now and the Reserve a few months later when you’re officially hooked. (But, if you have a partner, they can! I have the Reserve and Jonathan got the 100K subscription bonus — $1250 — on the Preferred last year.)

The thing to note with the Sapphire cards is that you’re not married to any particular airline. You can use these points to transfer to multiple airlines and hotels, which is why I recommend the Chase Preferred over the Southwest card for the same annual fee. You can always choose the cheapest flight and not have to worry about where your loyalties lie.

Torn between the two Sapphire cards? There’s this calculator to help you decide which one would be the most bang for your buck.

From there, you get into real credit card hacking. We both got a Chase Freedom card during our renovation so we could put our appliances on it. These cards have no annual fee, along with a 15-month zero interest benefit, so we were able to delay paying for those until our renovation was completed and we knew there were no more surprises. Our businesses also both have a Chase Ink.

Whew, OK, that was a lot. Here’s the TL;DR — the Chase Reserve card is the absolute best if you spend a decent amount of money going out to eat and traveling and want awesome travel bonuses. These other cards are great supporting cards as well. I recommend the Sapphire Preferred is you don’t feel ready for the Reserve annual fee.

Google Flights.

OK, so we’ve subscribed to receive cheap flights, and we’ve signed up for awesome travel rewards. How do I maximize all of this?

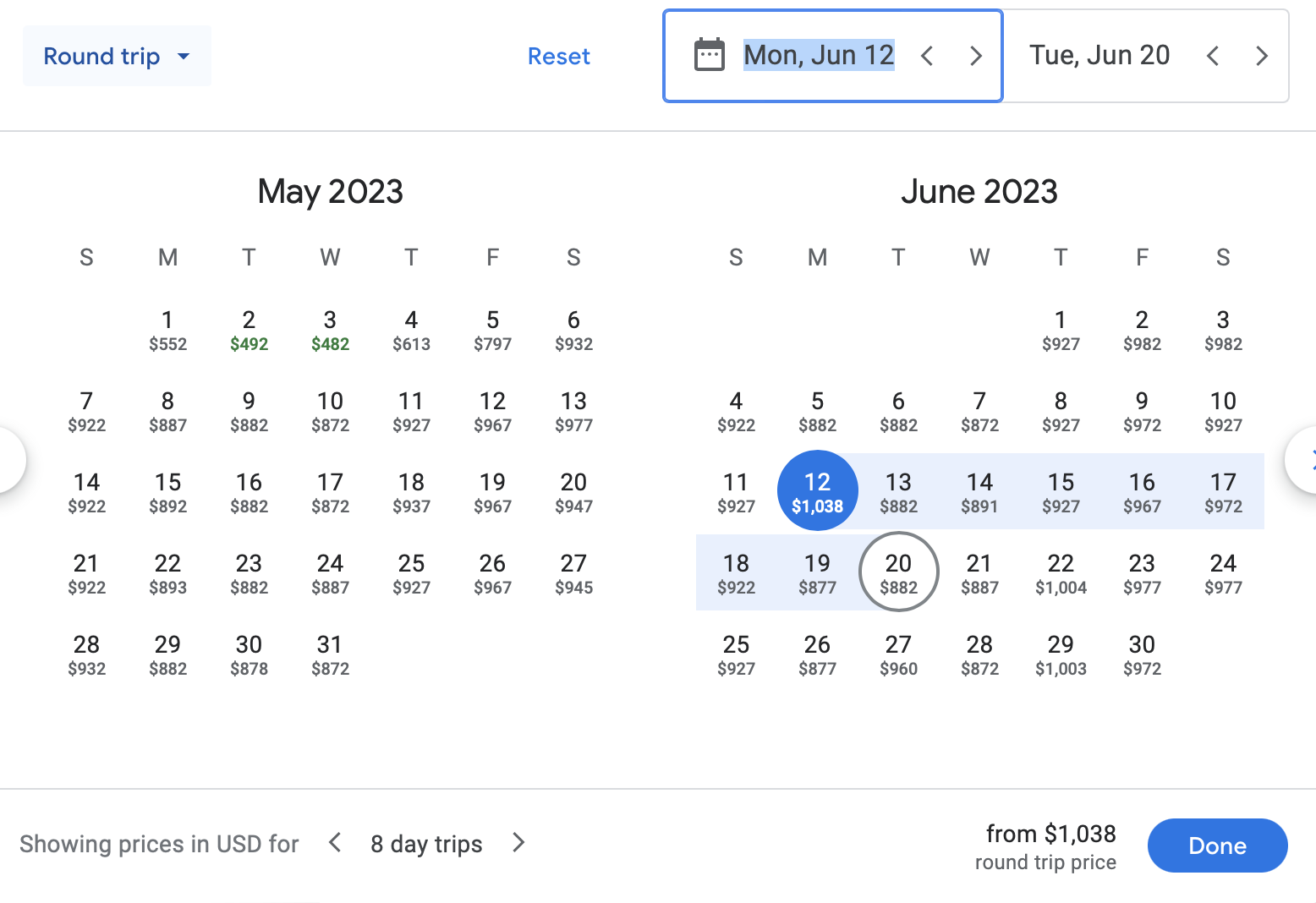

I use Google Flights to make sure I get the best deal possible. One of the places we’d really like to go is Barcelona. So I got a SCF notification that tickets to Barcelona were cheap right now. I went to Google Flights and typed in that I’d like to go from Nashville to Barcelona for approximately eight days. You’ll see here that if we went in June, we could pay up to $1000/person. But if we go in March, we could go for $442/person.

This is why I always recommend trying to travel with flexible dates when possible. We set our travel dates for when we can find cheapest flights or flights from the fewest points.

4. Budget.

Like I mentioned earlier, credit card points are only beneficial if you’re positive you can pay them off every month. We use YNAB (You Need A Budget) to make sure we can always put our cards on autopay so we never pay interest. With YNAB, if we get paid $1,000, I can budget $400 of that to groceries, $200 to restaurants, $100 to gas, and $300 to a vacation. When I go to the grocery store and spend $112 in groceries, YNAB takes that money from my grocery budget and moves it to my credit card payment budget line. This eliminated a lot of my discomfort around missing a payment, so as long as I’m on top of my budget and not spending more than I have, everything stays up to date. We also budget out our annual fees here into monthly payments, so we set aside $8.50/month for the Chase Preferred and $45/month for the Chase Reserve.

5. Take the 10x Travel Course.

On our first business class flight from JFK to Paris in September 2022. We used 70K points and paid $144 per person.

If this all sounds confusing but intriguing, there’s a free course that’s dedicated to baby stepping you through credit card travel hacking. It’s called 10x Travel, and I can’t recommend it enough. It’s what gave me the confidence to start getting more cards and earning subscription bonuses. Between Jonathan and me, we now have about $7,000 left of free travel after our trip to Croatia where we spent some serious points on our first business class experience. We also have another $1000 subscription bonus coming our way on our next statement.

Soooo, questions? Happy to answer anything you want to know! I truly love talking about this and showing people how much money you can earn and save for travel when you find the right system. It sounds like a lot, but once you learn the ins and outs, it’s really easy, and totally worth the learning curve to get to see the world in ways we normally wouldn’t be able to.

And just a heads up, some of the credit cards links here and the YNAB link are referrals. We both get a little bonus if you use them, but I’m more than happy to answer any questions whether you use my link or not. :) If you do use my link, send me a message and let me know if you think about it! I’d love to know how you like it!

Rescources:

Chase Reserve - $550/year, $300 credit on first statement each year, Priority Pass lounge access, free TSA Pre/Global Entry, 80K subscription bonus ($1200), 50% bonus when booking travel, smaller benefits like a DoorDash subscription, Instacart subscription, and Lyft discounts.

Chase Preferred - $95/year, $50 credit for a hotel stay each year, 60K subscription bonus ($750), DoorDash subscription, Instacart subscription

Chase Freedom Cards - no annual fee, $200 (20,000 points) subscription bonus, 15-month 0% APR

YNAB - budgeting with YNAB help us make sure we never miss a credit card payment.

10x Travel Course - A free course that walks you through credit card travel hacking from beginner to advanced. I’m, crazily enough, probably somewhere in the middle.